Mobile fraud is believed to be costing the wireless industry up to $58 billion annually. That is more than 6% of revenue – in an industry with increasingly tight margins.

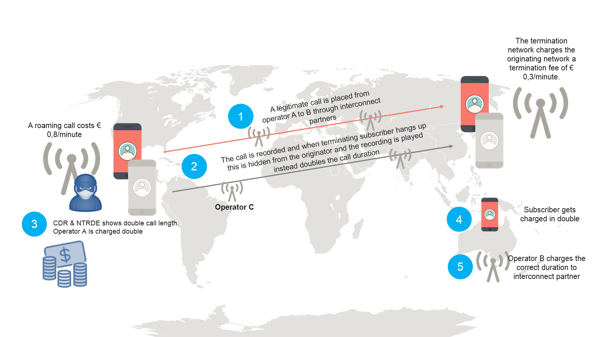

Fraud comes in all shapes and sizes, and can pop up in the most unlikely places. With the latest interconnect fraud scheme, not only is the subscriber not to blame, they actually are the victims and have no idea that they are being used to perpetuate this type of illicit activity. In a typical instance of this new type of fraud, the interconnect carrier is actually the fraudster.

It begins when a person makes a legitimate international call while roaming. The interconnect operator then records a portion of the voice call, and repeats it back to the caller once the terminating subscriber hangs up. This almost doubles the duration of the call, and also doubles the resulting charges for both the subscriber and the originating operator, who end up paying higher fees. The fraudulent interconnect carrier gets more than their share - collecting almost double what they are rightfully owed.

In an example scenario, a customer roaming in Eastern Europe calls to their home network in Spain. The call is intercepted by an interconnect carrer where a portion of the call is then recorded and played back to the caller. Based on SS7 signaling data on the terminating side, a call that lasted 1 minute and 24 seconds would appear as though it lasted perhaps 2 minutes and 22 seconds. This adds almost 1 full minute of fraudulent calling time, which would be charged to the customer as well as to the originating operator by their shady interconnect partner.

These types of fraud scenarios are difficult to catch and prevent specially if your system relies mostly of the detection on top of CDR’ analysis , but carriers that have the latest in fraud detection solutions are better equipped to weather both old and new types of mobile fraud. In this situation, fraud is detected when call duration data gathered from signaling data is automatically compared with the near real-time roaming data exchange, or NRTRDE. Inconsistencies are then immediately flagged to identify which calls are being tampered with, and the operator can cease sending traffic to these fraudulent intercarrier partners.

At WeDo Technologies, we know mobile fraud is serious business. Being able to easily interpret disparate types of events to quickly identify potential fraud risks can be a challenge. To help fraud managers identify changes or patterns not visible in rows and columns of data, RAID:FMS includes an advanced set of collection, processing and visualization tools capable of highlighting and providing context during detection, investigation and case resolution of even the most challenging fraud scenarios. For more information on how we can help, talk to our expert.

Let Us Know What You Thought about this Post.

Put your Comment Below.